Are you over 18 and want to see adult content?

More Annotations

A complete backup of https://aivex.ru

Are you over 18 and want to see adult content?

A complete backup of https://innovasjonnorge.no

Are you over 18 and want to see adult content?

A complete backup of https://exacthire.com

Are you over 18 and want to see adult content?

A complete backup of https://digimation.com

Are you over 18 and want to see adult content?

A complete backup of https://emep.int

Are you over 18 and want to see adult content?

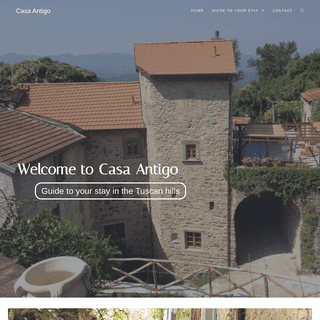

A complete backup of https://casa-antigo.eu

Are you over 18 and want to see adult content?

A complete backup of https://thellcblog.biz

Are you over 18 and want to see adult content?

A complete backup of https://aburhani.com

Are you over 18 and want to see adult content?

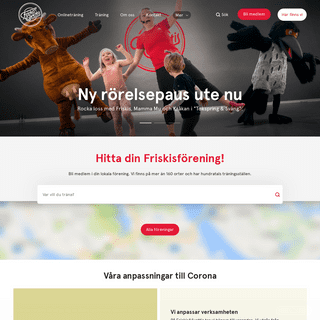

A complete backup of https://friskissvettis.se

Are you over 18 and want to see adult content?

A complete backup of https://piercingmania.co.uk

Are you over 18 and want to see adult content?

A complete backup of https://petaasiapacific.com

Are you over 18 and want to see adult content?

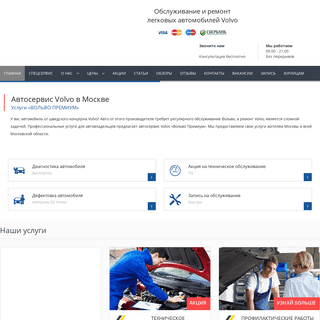

A complete backup of https://volvopremium.ru

Are you over 18 and want to see adult content?

Favourite Annotations

A complete backup of https://sakurity.com

Are you over 18 and want to see adult content?

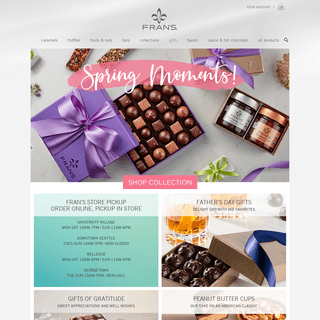

A complete backup of https://frans.com

Are you over 18 and want to see adult content?

A complete backup of https://apprisen.com

Are you over 18 and want to see adult content?

A complete backup of https://polacup.com

Are you over 18 and want to see adult content?

A complete backup of https://natchezdemocrat.com

Are you over 18 and want to see adult content?

A complete backup of https://thezeitgeistmovement.com

Are you over 18 and want to see adult content?

A complete backup of https://memontum.com

Are you over 18 and want to see adult content?

A complete backup of https://mossovetinfo.ru

Are you over 18 and want to see adult content?

A complete backup of https://echodnia.eu

Are you over 18 and want to see adult content?

A complete backup of https://heidenheim.de

Are you over 18 and want to see adult content?

A complete backup of https://winreview.ru

Are you over 18 and want to see adult content?

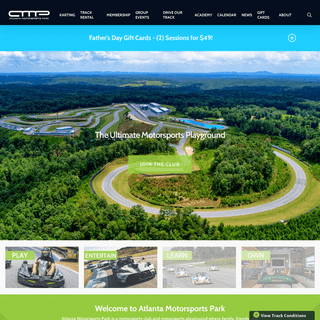

A complete backup of https://atlantamotorsportspark.com

Are you over 18 and want to see adult content?

Text

or come by a

ELECTRONIC BANKING

Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More.OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450% SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash SOUTHWEST PARKWAY & DOWNTOWN LOBBIES ARE NOW OPEN COVID-19 Coronavirus Safety Update: May 26, 2020 Our lobbies are now open for business at our Southwest Parkway and Downtown branches! Our Sheppard Access Road branch lobbies will continue to remain closed (entry by appointment only) as construction continues on our remodel. (Anticipated reopening this Summer!) When visiting a branch, we are strongly encouraging staff HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

ELECTRONIC BANKING

Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More.OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450% SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash SOUTHWEST PARKWAY & DOWNTOWN LOBBIES ARE NOW OPEN COVID-19 Coronavirus Safety Update: May 26, 2020 Our lobbies are now open for business at our Southwest Parkway and Downtown branches! Our Sheppard Access Road branch lobbies will continue to remain closed (entry by appointment only) as construction continues on our remodel. (Anticipated reopening this Summer!) When visiting a branch, we are strongly encouraging staff RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450%OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 REWARDS YOU'LL LOVE! Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

FREE CHECKING ACCOUNTS Cash Back Checking. Cash Back free checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. LearnMore.

IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

FAQS - TEXOMA COMMUNITY CREDIT UNION 3. Instructions are also included when the card is mailed. Click here. 4. Online banking users received a message inside online banking on August 25. 5. TCCU also had lobby signage, flyers in the branches, digitally displayed in the monitors in the branches, and an WHY IS THERE STILL A SHORTAGE ON SOME GOODS? In fact, according to IRI, a market research firm, demand for toilet paper swelled to such great heights in March, that sales peaked at $1.45 billion for the four-week period ending March 29. That’s a 112% increase from a year earlier. “I can’t give you an exact number, but I will tell you we’re making more than ever,” saysArist

CLICKSWITCH

ClickSWITCH is an online portal that assists in efficiently switching your recurring payments from old accounts to a new one. It’s free, automated and easier than ever before. With ClickSWITCH you can change financial institutions or move old accounts without the hassles of filling out multiple forms or wasting time contacting payees for HOW LONG DOES IT TAKE FOR MY DEBIT CARD TO ARRIVE? HOW CAN How long does the card take to arrive? A Card takes 5-7 business days to arrive. The PIN is mailed first and the card will follow two days later. A card can be overnighted at a cost of $45 to our members. The term overnight actually means it takes two days. The production willtake

6. ACCOUNTS SUBJECT TO TUTMA 6. ACCOUNTS SUBJECT TO TUTMA - An account designated as subject to the Texas Uniform Transfers to Minors Act (TUTMA) is a single party account for a minor. The account is created by the transfer of funds into an account subject to the TUTMA for a named HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

ELECTRONIC BANKING

Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More.OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450% SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash SOUTHWEST PARKWAY & DOWNTOWN LOBBIES ARE NOW OPEN COVID-19 Coronavirus Safety Update: May 26, 2020 Our lobbies are now open for business at our Southwest Parkway and Downtown branches! Our Sheppard Access Road branch lobbies will continue to remain closed (entry by appointment only) as construction continues on our remodel. (Anticipated reopening this Summer!) When visiting a branch, we are strongly encouraging staff HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

ELECTRONIC BANKING

Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More.OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450% SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash SOUTHWEST PARKWAY & DOWNTOWN LOBBIES ARE NOW OPEN COVID-19 Coronavirus Safety Update: May 26, 2020 Our lobbies are now open for business at our Southwest Parkway and Downtown branches! Our Sheppard Access Road branch lobbies will continue to remain closed (entry by appointment only) as construction continues on our remodel. (Anticipated reopening this Summer!) When visiting a branch, we are strongly encouraging staff RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450%OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 REWARDS YOU'LL LOVE! Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

FREE CHECKING ACCOUNTS Cash Back Checking. Cash Back free checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. LearnMore.

IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

FAQS - TEXOMA COMMUNITY CREDIT UNION 3. Instructions are also included when the card is mailed. Click here. 4. Online banking users received a message inside online banking on August 25. 5. TCCU also had lobby signage, flyers in the branches, digitally displayed in the monitors in the branches, and an WHY IS THERE STILL A SHORTAGE ON SOME GOODS? In fact, according to IRI, a market research firm, demand for toilet paper swelled to such great heights in March, that sales peaked at $1.45 billion for the four-week period ending March 29. That’s a 112% increase from a year earlier. “I can’t give you an exact number, but I will tell you we’re making more than ever,” saysArist

CLICKSWITCH

ClickSWITCH is an online portal that assists in efficiently switching your recurring payments from old accounts to a new one. It’s free, automated and easier than ever before. With ClickSWITCH you can change financial institutions or move old accounts without the hassles of filling out multiple forms or wasting time contacting payees for HOW LONG DOES IT TAKE FOR MY DEBIT CARD TO ARRIVE? HOW CAN How long does the card take to arrive? A Card takes 5-7 business days to arrive. The PIN is mailed first and the card will follow two days later. A card can be overnighted at a cost of $45 to our members. The term overnight actually means it takes two days. The production willtake

6. ACCOUNTS SUBJECT TO TUTMA 6. ACCOUNTS SUBJECT TO TUTMA - An account designated as subject to the Texas Uniform Transfers to Minors Act (TUTMA) is a single party account for a minor. The account is created by the transfer of funds into an account subject to the TUTMA for a named HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash REWARDS YOU'LL LOVE! Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

FAQS - TEXOMA COMMUNITY CREDIT UNION 3. Instructions are also included when the card is mailed. Click here. 4. Online banking users received a message inside online banking on August 25. 5. TCCU also had lobby signage, flyers in the branches, digitally displayed in the monitors in the branches, and an SOUTHWEST PARKWAY BRANCH Southwest Parkway Branch. Hours: Lobby Hours: Mon-Fri: 9:00 AM to 4:30 PM Saturday: 9:00 AM to 12:00 PM Drive-Thru Hours: Mon-Fri: 8:30 AM -6:00 PM

SOUTHWEST PARKWAY & DOWNTOWN LOBBIES ARE NOW OPEN COVID-19 Coronavirus Safety Update: May 26, 2020 Our lobbies are now open for business at our Southwest Parkway and Downtown branches! Our Sheppard Access Road branch lobbies will continue to remain closed (entry by appointment only) as construction continues on our remodel. (Anticipated reopening this Summer!) When visiting a branch, we are strongly encouraging staff HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash REWARDS YOU'LL LOVE! Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

FAQS - TEXOMA COMMUNITY CREDIT UNION 3. Instructions are also included when the card is mailed. Click here. 4. Online banking users received a message inside online banking on August 25. 5. TCCU also had lobby signage, flyers in the branches, digitally displayed in the monitors in the branches, and an SOUTHWEST PARKWAY BRANCH Southwest Parkway Branch. Hours: Lobby Hours: Mon-Fri: 9:00 AM to 4:30 PM Saturday: 9:00 AM to 12:00 PM Drive-Thru Hours: Mon-Fri: 8:30 AM -6:00 PM

SOUTHWEST PARKWAY & DOWNTOWN LOBBIES ARE NOW OPEN COVID-19 Coronavirus Safety Update: May 26, 2020 Our lobbies are now open for business at our Southwest Parkway and Downtown branches! Our Sheppard Access Road branch lobbies will continue to remain closed (entry by appointment only) as construction continues on our remodel. (Anticipated reopening this Summer!) When visiting a branch, we are strongly encouraging staff REWARDS YOU'LL LOVE! Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

ABOUT US - TEXOMA COMMUNITY CREDIT UNION The Credit Union Difference Unlike a big bank, we believe in putting you first, whether it comes to great rates or great service. We are part of you. We support the community where you live and work. You’ll find our staff and board members at your fundraisers, at your ball games, at your kids’ school, IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

TCCU PEOPLE

ken@texomacu.com. Ken has enjoyed the awesome opportunity to serve as Texoma Community Credit Union’s Chief Lending Officer since 1996 and has enjoyed being with Texoma since October 1986. He supervises all lending and collection functions, managing more $130 million loan portfolio with remarkably low delinquency and charge-offs.E-STATEMENTS

E-Statements are the safest way to view your account details! Benefits: Help protect your identity. The mail box is a easy way for a criminal to compromise your identity. Use a tool that is environmentally friendly. Up to 18 months’ worth of statements are available online. That’s a lotCLICKSWITCH

ClickSWITCH is an online portal that assists in efficiently switching your recurring payments from old accounts to a new one. It’s free, automated and easier than ever before. With ClickSWITCH you can change financial institutions or move old accounts without the hassles of filling out multiple forms or wasting time contacting payees forCASHTASTIC CHECKING

Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

SOUTHWEST PARKWAY & DOWNTOWN LOBBIES ARE NOW OPEN COVID-19 Coronavirus Safety Update: May 26, 2020 Our lobbies are now open for business at our Southwest Parkway and Downtown branches! Our Sheppard Access Road branch lobbies will continue to remain closed (entry by appointment only) as construction continues on our remodel. (Anticipated reopening this Summer!) When visiting a branch, we are strongly encouraging staffCASH BACK CHECKING

Earn cash back and refunds on ATM withdrawal fees.*. Whether it’s a trip down to the grocery store, a tank of gas, or anything else, Cash Back Checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. You’ll also get cash back with refunds on your ATM withdrawal fees, nationwide — so every ATM becomesKEN THOMASON

Ken has enjoyed the awesome opportunity to serve as Texoma Community Credit Union’s Chief Lending Officer since 1996 and has enjoyed being with Texoma since October 1986. He supervises all lending and collection functions, managing more $130 million loan portfolio with remarkably low delinquency and charge-offs. Ken grew up in Wichita Falls and graduated from HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

CASHTASTIC CHECKING

Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

CASHTASTIC CHECKING

Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

NEWS - TEXOMA COMMUNITY CREDIT UNION TCCU HOSTS TREE OF LIFE FOR CLIENTS OF APS, DECEMBER 1 – 15, 2020. Nov 4, 2020. It isn’t easy to think of adults as victims of abuse, neglect, or exploitation. Yet every day in Texoma, there are men and women who need the assistance of Adult Protective Services. APS works to remove these individuals from harm’s way, but can not alwaysOPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 FREE CHECKING ACCOUNTS Downtown Branch. Lobby Hours: Mon-Fri: 9:00 AM to 4:30 PM Saturday: Closed Drive-Thru Hours (817 8th St.): Mon-Fri: 8:30 AM to 6:00 PM Saturday: 9:00 AM to 12:00 PM RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450%CASHTASTIC CHECKING

Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

FAQS - TEXOMA COMMUNITY CREDIT UNION 3. Instructions are also included when the card is mailed. Click here. 4. Online banking users received a message inside online banking on August 25. 5. TCCU also had lobby signage, flyers in the branches, digitally displayed in the monitors in the branches, and anOVERDRAFT COVERAGE

OVERDRAFT COVERAGE OPTIONS: OVERDRAFT PROTECTION AND Overdraft Privilege Life happens! Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com, or come by a branchCASH BACK CHECKING

Earn cash back and refunds on ATM withdrawal fees.*. Whether it’s a trip down to the grocery store, a tank of gas, or anything else, Cash Back Checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. You’ll also get cash back with refunds on your ATM withdrawal fees, nationwide — so every ATM becomes EMPLOYMENT OPPORTUNITIES Employment Opportunities. We are always accepting applications! Your completed application will be forwarded to departments with openings that match your skills, background, and education. Should there be a match, and we are in need of candidates, we will contact you to schedule an interview. Otherwise, we will keep your application onfile for

LOVE MY CREDIT UNION REWARDS Love My Credit Union Rewards gives credit union members access to many exclusive discounts and benefits from great partners like Sprint, TurboTax, TruStage Insurance, and SimpliSafe home security. TurboTax Save Up to 25% on TurboTax Members can save up to $15 on TurboTax online federal tax products. TurboTax is America’s #1 online tax preparation service. HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

CASHTASTIC CHECKING

Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

CASHTASTIC CHECKING

Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

NEWS - TEXOMA COMMUNITY CREDIT UNION TCCU HOSTS TREE OF LIFE FOR CLIENTS OF APS, DECEMBER 1 – 15, 2020. Nov 4, 2020. It isn’t easy to think of adults as victims of abuse, neglect, or exploitation. Yet every day in Texoma, there are men and women who need the assistance of Adult Protective Services. APS works to remove these individuals from harm’s way, but can not alwaysOPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 FREE CHECKING ACCOUNTS Downtown Branch. Lobby Hours: Mon-Fri: 9:00 AM to 4:30 PM Saturday: Closed Drive-Thru Hours (817 8th St.): Mon-Fri: 8:30 AM to 6:00 PM Saturday: 9:00 AM to 12:00 PM RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450%CASHTASTIC CHECKING

Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

FAQS - TEXOMA COMMUNITY CREDIT UNION 3. Instructions are also included when the card is mailed. Click here. 4. Online banking users received a message inside online banking on August 25. 5. TCCU also had lobby signage, flyers in the branches, digitally displayed in the monitors in the branches, and anOVERDRAFT COVERAGE

OVERDRAFT COVERAGE OPTIONS: OVERDRAFT PROTECTION AND Overdraft Privilege Life happens! Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com, or come by a branchCASH BACK CHECKING

Earn cash back and refunds on ATM withdrawal fees.*. Whether it’s a trip down to the grocery store, a tank of gas, or anything else, Cash Back Checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. You’ll also get cash back with refunds on your ATM withdrawal fees, nationwide — so every ATM becomes EMPLOYMENT OPPORTUNITIES Employment Opportunities. We are always accepting applications! Your completed application will be forwarded to departments with openings that match your skills, background, and education. Should there be a match, and we are in need of candidates, we will contact you to schedule an interview. Otherwise, we will keep your application onfile for

LOVE MY CREDIT UNION REWARDS Love My Credit Union Rewards gives credit union members access to many exclusive discounts and benefits from great partners like Sprint, TurboTax, TruStage Insurance, and SimpliSafe home security. TurboTax Save Up to 25% on TurboTax Members can save up to $15 on TurboTax online federal tax products. TurboTax is America’s #1 online tax preparation service. HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen.OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

CASH BACK CHECKING

Earn cash back and refunds on ATM withdrawal fees.*. Whether it’s a trip down to the grocery store, a tank of gas, or anything else, Cash Back Checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. You’ll also get cash back with refunds on your ATM withdrawal fees, nationwide — so every ATM becomes HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen.OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

CASH BACK CHECKING

Earn cash back and refunds on ATM withdrawal fees.*. Whether it’s a trip down to the grocery store, a tank of gas, or anything else, Cash Back Checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. You’ll also get cash back with refunds on your ATM withdrawal fees, nationwide — so every ATM becomes NEWS - TEXOMA COMMUNITY CREDIT UNION TCCU HOSTS TREE OF LIFE FOR CLIENTS OF APS, DECEMBER 1 – 15, 2020. Nov 4, 2020. It isn’t easy to think of adults as victims of abuse, neglect, or exploitation. Yet every day in Texoma, there are men and women who need the assistance of Adult Protective Services. APS works to remove these individuals from harm’s way, but can not alwaysOPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 FREE CHECKING ACCOUNTS Downtown Branch. Lobby Hours: Mon-Fri: 9:00 AM to 4:30 PM Saturday: Closed Drive-Thru Hours (817 8th St.): Mon-Fri: 8:30 AM to 6:00 PM Saturday: 9:00 AM to 12:00 PM RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450%CASH BACK CHECKING

Earn cash back and refunds on ATM withdrawal fees.*. Whether it’s a trip down to the grocery store, a tank of gas, or anything else, Cash Back Checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. You’ll also get cash back with refunds on your ATM withdrawal fees, nationwide — so every ATM becomesCASHTASTIC CHECKING

Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

FAQS - TEXOMA COMMUNITY CREDIT UNION 3. Instructions are also included when the card is mailed. Click here. 4. Online banking users received a message inside online banking on August 25. 5. TCCU also had lobby signage, flyers in the branches, digitally displayed in the monitors in the branches, and anCLICKSWITCH

ClickSWITCH is an online portal that assists in efficiently switching your recurring payments from old accounts to a new one. It’s free, automated and easier than ever before. With ClickSWITCH you can change financial institutions or move old accounts without the hassles of filling out multiple forms or wasting time contacting payees for EMPLOYMENT OPPORTUNITIES Employment Opportunities. We are always accepting applications! Your completed application will be forwarded to departments with openings that match your skills, background, and education. Should there be a match, and we are in need of candidates, we will contact you to schedule an interview. Otherwise, we will keep your application onfile for

LOVE MY CREDIT UNION REWARDS Love My Credit Union Rewards gives credit union members access to many exclusive discounts and benefits from great partners like Sprint, TurboTax, TruStage Insurance, and SimpliSafe home security. TurboTax Save Up to 25% on TurboTax Members can save up to $15 on TurboTax online federal tax products. TurboTax is America’s #1 online tax preparation service. HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen.OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

CASH BACK CHECKING

Earn cash back and refunds on ATM withdrawal fees.*. Whether it’s a trip down to the grocery store, a tank of gas, or anything else, Cash Back Checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. You’ll also get cash back with refunds on your ATM withdrawal fees, nationwide — so every ATM becomes HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen.OPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

CASH BACK CHECKING

Earn cash back and refunds on ATM withdrawal fees.*. Whether it’s a trip down to the grocery store, a tank of gas, or anything else, Cash Back Checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. You’ll also get cash back with refunds on your ATM withdrawal fees, nationwide — so every ATM becomes NEWS - TEXOMA COMMUNITY CREDIT UNION TCCU HOSTS TREE OF LIFE FOR CLIENTS OF APS, DECEMBER 1 – 15, 2020. Nov 4, 2020. It isn’t easy to think of adults as victims of abuse, neglect, or exploitation. Yet every day in Texoma, there are men and women who need the assistance of Adult Protective Services. APS works to remove these individuals from harm’s way, but can not alwaysOPEN AN ACCOUNT

To establish a membership with Texoma Community Credit Union, you must open and maintain a Savings Account with a minimum balance of $25.00. I understand that a Savings Account is required for membership with a minimum balance of $25. I also understand that if I am NOT currently a member of Texoma Community CU that I will be required to add $25 FREE CHECKING ACCOUNTS Downtown Branch. Lobby Hours: Mon-Fri: 9:00 AM to 4:30 PM Saturday: Closed Drive-Thru Hours (817 8th St.): Mon-Fri: 8:30 AM to 6:00 PM Saturday: 9:00 AM to 12:00 PM RATES - TEXOMA COMMUNITY CREDIT UNION TCCU consistently has lower than market average lending rates and higher than average deposit rates. If you are shopping for a loan or have money to deposits, then TCCU is the place for better than average deals. Rates Sheet (PDF) Checking Account Dividends Rate A.P.Y. Cashtastic Checking** Qualifying Up to $10,000 3.450%CASH BACK CHECKING

Earn cash back and refunds on ATM withdrawal fees.*. Whether it’s a trip down to the grocery store, a tank of gas, or anything else, Cash Back Checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. You’ll also get cash back with refunds on your ATM withdrawal fees, nationwide — so every ATM becomesCASHTASTIC CHECKING

Reward Information: When your Cashtastic Checking account qualifications are met during a Monthly Qualification Cycle, (1) balances up to $10,000 receive APY of 3.51%; and balances over $10,000 earn 0.25% interest rate on the portion of balance over $10,000, and (2) you will receive reimbursements up to an aggregate total of $10for nationwide

FAQS - TEXOMA COMMUNITY CREDIT UNION 3. Instructions are also included when the card is mailed. Click here. 4. Online banking users received a message inside online banking on August 25. 5. TCCU also had lobby signage, flyers in the branches, digitally displayed in the monitors in the branches, and anCLICKSWITCH

ClickSWITCH is an online portal that assists in efficiently switching your recurring payments from old accounts to a new one. It’s free, automated and easier than ever before. With ClickSWITCH you can change financial institutions or move old accounts without the hassles of filling out multiple forms or wasting time contacting payees for EMPLOYMENT OPPORTUNITIES Employment Opportunities. We are always accepting applications! Your completed application will be forwarded to departments with openings that match your skills, background, and education. Should there be a match, and we are in need of candidates, we will contact you to schedule an interview. Otherwise, we will keep your application onfile for

LOVE MY CREDIT UNION REWARDS Love My Credit Union Rewards gives credit union members access to many exclusive discounts and benefits from great partners like Sprint, TurboTax, TruStage Insurance, and SimpliSafe home security. TurboTax Save Up to 25% on TurboTax Members can save up to $15 on TurboTax online federal tax products. TurboTax is America’s #1 online tax preparation service. HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306 SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash FREE CHECKING ACCOUNTS Cash Back Checking. Cash Back free checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. LearnMore.

IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

LOANS - TEXOMA COMMUNITY CREDIT UNION We will work hard to help you get the loan you need. And you’ll have the comfort of knowing the TCCU loan experience will be personalized to meet your needs. There’s a loan officer ready to help you through the process. Simply come in to a branch, give us a call at 940-851-4000, or get a head start by filling out your applicationonline.

HOME - TEXOMA COMMUNITY CREDIT UNIONSERVICESCONTACTNEWSATMSINSURANCELOANS Home - Texoma Community Credit Union. Just wanted to say "Thank You" for sponsoring "God Is Not Dead" tonight. We very much enjoyed it! Mitchell Kidd. 7 years ago. I love this credit union! Awesome people! Erlinda Garcia Paniagua. 7 years ago. SERVICES - TEXOMA COMMUNITY CREDIT UNION Texoma Community Credit Union understands that unexpected overdrafts occur from time to time – Overdraft Coverage can help. Overdraft Coverage Options The choice is yours. Consider these ways to cover overdrafts: 1Call us at (940) 851-4000, email us at OPM@TexomaCU.com,or come by a

MOBILE BANKING

TCCU Mobile App. Available in the Google Play and Apple App Store, the FREE TCCU Mobile App allows you to check your balance and account summary, transfer funds, make payments, and update your password. Features Include: Mobile Deposit for checks. Debit “Pause” Button to halt transactions when a card is lost or stolen. CONTACT - TEXOMA COMMUNITY CREDIT UNION Sheppard Access Road Branch. Lobby Hours: Mon-Fri: 9:00 AM - 4:30 PM Drive-Thru Hours: Mon-Fri: 8:30 AM to 6:00 PM. 3800 Sheppard Access Road Wichita Falls, TX 76306 SBA PAYCHECK PROTECTION PROGRAM LOANS SBA Paycheck Protection Program Loans. The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. PERSONAL CREDIT CARDS Visa® College Real Rewards Card. Earn 1.5 points for every dollar you spend on eligible purchases. 4. No cap or limit on the points you can earn, plus you have five years to redeem points for rewards. 3. 2,500 bonus rewards points awarded after first purchases 5 , redeemable for $25 cash back, merchandise, gift cards or travel savings. Learn More. MAKE YOUR LOAN PAYMENT ONLINE Pay From Your TCCU Account Click here to access your online banking. Pay From Another Debit or Credit Card* Pay Now *This loan payment service is intended for payments to be applied to loans only. To make a deposit to your savings or checking account, please visit one of our branches to conduct a cash FREE CHECKING ACCOUNTS Cash Back Checking. Cash Back free checking pays 3.00% cash back on your debit card purchases — up to $144 cash back per year!*. LearnMore.

IRAS - TEXOMA COMMUNITY CREDIT UNION IRAs (Individual Retirement Accounts) with us are the safe, smart choice for planning your future. Our IRAs are invested in our Certificates of Deposit, not the stock market, so there is a guaranteed rate of return. How much is up to you – depending on howlong you

LOANS - TEXOMA COMMUNITY CREDIT UNION We will work hard to help you get the loan you need. And you’ll have the comfort of knowing the TCCU loan experience will be personalized to meet your needs. There’s a loan officer ready to help you through the process. Simply come in to a branch, give us a call at 940-851-4000, or get a head start by filling out your applicationonline.

OPEN AN ACCOUNT